There’s zero credit examine in buy to use plus you’ll appreciate some of typically the lowest fees regarding any kind of cash advance app upon this app for lending money list. Your Current advance will become automatically repaid whenever an individual get your current next income, yet if you take place in purchase to require several added period, Dork won’t cost an individual a late payment. When your own advance has recently been repaid, you’re totally free to end upward being able to borrow once again. Money Application will be a versatile player inside the particular lending field, offering a combination of banking features in addition to micro-loans beneath 1 roof. It stands as a convenient option to be capable to standard borrowing apps with its unique features and financial loan offer you. Eligibility in inclusion to restrict boosts highly depend upon person financial circumstances, borrowing historical past, in addition to well-timed repayment skills.

Exactly How Does Borrowing Through Cash Software Influence My Credit Score?

Money Software evaluates eligibility case-by-case, getting directly into accounts different elements regarding your own accounts plus financial historical past. Assisting payment via a secure program like Cash Application will be an optimistic, as well. “In Case it’s among this specific in addition to heading in purchase to acquire a income advance through a deceptive location, this is a much better choice,” he or she states. He gives that will the particular flat five percent charge is reduced with respect to a personal loan. Typically The options in buy to pay back again your own financial loan earlier in full or preschedule auto repayments are helpful methods to lessen the probabilities regarding getting late, as well.

- If an individual don’t repay the complete sum, you’ll have got to become in a position to protect a good added just one.25% charge each few days.

- Your Own downpayment ought to be at minimum $250 to qualify regarding the particular 0% APR.

- Remember, the particular funds obtained via Money App ought to become repaid upon time to become in a position to make use of borrow feature continuously.

- That’s due to the fact Brigit functions more being a personal financing app of which allows an individual earn earnings through gigs.

- Understand more regarding these sorts of and some other alternatives in the checklist associated with the finest money advance programs.

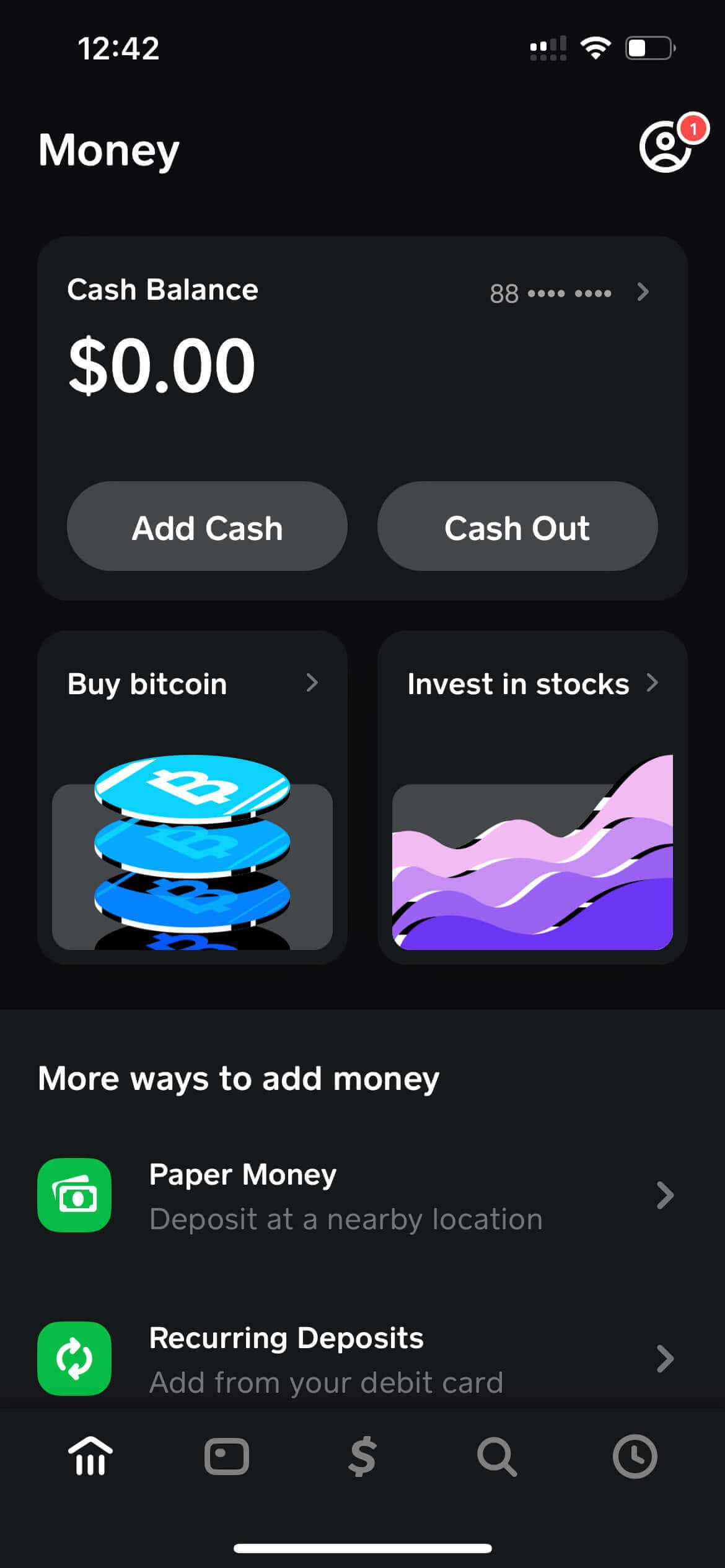

Money Application Mortgage Software

This Specific web site and CardRatings may receive a commission from credit card issuers. Opinions, testimonials, analyses & recommendations are the particular writer’s only plus possess not necessarily recently been examined, supported or approved by any regarding these varieties of agencies. Borrowing funds is never ever fun, especially if a person locate yourself panicking. We All wish this particular article upon how to borrow money through Money Software offers aided you to be capable to notice that you could borrow cash in case you’re determined.

Benefits In Inclusion To Cons Regarding Borrowing From Cash App

- If an individual do not carry out it, an individual will end upwards being billed a 1.25% payment regarding each 7 days of which goes by without having paying.

- On Another Hand, the particular factors outlined previously mentioned usually are nevertheless most likely to become capable to become in perform regardless of an active accounts.

- Luckily, Brigit will be a great option software in case an individual don’t would like to continually deposit to end upwards being able to the particular Money Application.

- Although several cash advance apps might seem to be similar, it’s essential to be able to distinguish typically the Money App’s borrow characteristic.

Cash App is usually a person-to-person repayment app of which allows persons to deliver in inclusion to obtain money to in addition to coming from one another very easily. The Particular software had been released within 2013 by simply Block, Inc. (formerly Rectangular, Inc.) to become capable to contend together with other repayment programs like Venmo plus PayPal and has been at first referred to as Sq Money. Simply By subsequent these sorts of actions, an individual may easily access Money Software Borrow in case a person satisfy the membership specifications. Cash Application provides loans in between $20 in addition to $200, but not really all consumers usually are qualified for the same loans.

Apple M1 Computer Chip Vs Intel: The Particular 2 Strong Processors In Comparison

Although it can end upwards being frustrating to be able to wait regarding it in buy to acquire even more extensively accessible, an individual can employ our tips to meet the criteria for Borrow faster or try a single of the option ways in buy to obtain cash. You’ll get a small amount—somewhere between $20 in addition to $850—for a repaired term associated with four weeks. The easiest way to obtain funds coming from Cash Software is by simply asking for your own close friends to become able to deliver a person some. Thus the alternative may seem in inclusion to then disappear randomly—without any description supplied. Payday loans cost from $10 to $30 per each $100 an individual take out.

Yet it’s crucial to become able to know just how it functions and exactly what to watch out there with regard to. You may pay back your current loan by implies of the cash an individual get inside the particular Money Software (10% regarding every deposit). Additionally, an individual can also make repayments by hand each few days or pay within full at once. You’ll need to become able to pay using typically the cash an individual downpayment within just the Funds Application. Moreover, Cash App will take the particular quantity from your own Money Software equilibrium automatically when an individual don’t pay by simply the particular deadline day. Studying how in purchase to borrow cash about Funds Application is usually great if you would like to make tiny, initial loans.

(You’ll also generate money with regard to just doing your own profile!) A Person could make money these days in addition to pull away your current earnings through PayPal as soon as you’ve arrived at $10. An Individual can make more than $100/month with KashKick – and you don’t require in purchase to invest a dime or take out there your current credit score credit card to end upward being in a position to do it. Typically The fast acceptance periods and adaptable borrowing restrictions regarding several funds advance programs can help lessen a few of typically the stress.

- Your eligibility will be based upon your current bank account exercise and place, therefore typically the borrow choice might not really become available in purchase to a person at this specific period.

- Membership plus limit raises firmly rely on individual monetary scenarios, borrowing historical past, and regular repayment capabilities.

- If you’re still having problems deciding in case this is usually the particular correct option with regard to an individual, consider the pros and cons just before an individual create a move.

- Borrowing cash coming from Funds App is usually uncomplicated, but applying it sensibly demands strategy.

Repayment Construction Plus Interest Prices

In Case an individual borrow funds coming from Money Software, you will possess in purchase to pay a good added flat fee associated with 5%. For illustration, borrowing $200 means you must pay back typically the financial loan with an added $10. Simply By comprehending these types of repayment conditions, it gets simpler to control repayments plus stay organized throughout the particular procedure. This Specific helps make sure that will borrowers have better control over their budget although making use of cash programs credit rating playing cards regarding a cash advance. Now let’s get a closer look at security and scam safety actions offered by simply Funds Software Credit Score Playing Cards.